or, How To Ruin Your Life In 5 Easy Steps

The other day, somewhere in California, some (un)lucky SOB won over 2 billion dollars on the US Powerball lottery. I’d like to be the first to offer my condolences to the winner. Why? The fact that they live in a state that requires winners to divulge their names to claim the prize is the first strike against them. When they eventually come forward to claim the prize, they’ll need an exit strategy to avoid all the bottom feeders and smarmy family members looking for their cut. No, I can’t quite feel happy for the poor sods.

I’d like to point out that I am not a lottery player. Oh sure, when the 6/49 gets up to 12 or 15 million I’ll pick up a couple of Quick Picks. Hey, you never know! Isn’t there a saying somewhere that says “You can’t win if you don’t play”? I just don’t participate on a regular basis.

I don’t say this to pretend to be a better person than someone who plays the lottery game. It’s just I have an aversion to most forms of gambling. And isn’t buying lottery tickets a form of gambling?

My Life As A High Roller

Here’s a bit of a side story to that comment. Because it’s not just that I have an aversion to gambling, it’s also because I’m not very good at it.

One time when Heather and I were still living on the Mainland as a couple of DINKs (Dual Income, No Kids!), we decided one Friday night to head out to the local casino. It was something different to do. We had a friend who played bingo regularly, and she always seemed to be coming home with hundreds of dollars. We thought, “Why not? Let’s give it a whirl!” So off we went to the gambling hall.

Being the adventurous, Devil May Care types, we decided to go in with 20 bucks each. When the money ran out, we would leave. So off we went, ready for a killing at the roulette table. This was going to be epic!

Fifteen minutes later, we looked at each other and said, “So what do you want to do now?” It would have been more rewarding if we had gone up to some homeless person and handed them our 20 dollar bills…

Nope, gambling’s just not my thing. Granted, if I were to win the lottery, I might change my tune. After all, to win I’d need to buy a ticket. Although I probably wouldn’t be the best spokesperson for the Lottery Corporation If I actually won. “Yeah, I don’t really buy lottery tickets, except this once. I just think it’s a waste of money.”

If I Had A Million Dollars, Would I Be Rich?

Rather, this is a good time to look at what not to do if I had a million dollars, or more, from a winning ticket. There are just so many ways a big lottery win can screw up your life. I read somewhere that around 70 percent of lottery winners lose or spend all their winnings (and more!) in five years or less. Yikes! How does something so good, go so wrong? Well, let’s count the ways…

1. Don’t Sign Your Ticket

There are some people in my town who have made buying lottery tickets their main retirement strategy. You’ve probably seen them where you live. Some man or woman is in front of you at the service counter, choosing a selection of scratch and win tickets from the display counter. Then they get a few Quick Picks for the Wednesday 6/49. A couple more tickets for the Friday Lotto Max. Before you’ve been able to get your 9 items or less through the till, they’ve spent fifty or sixty bucks on pure chance.

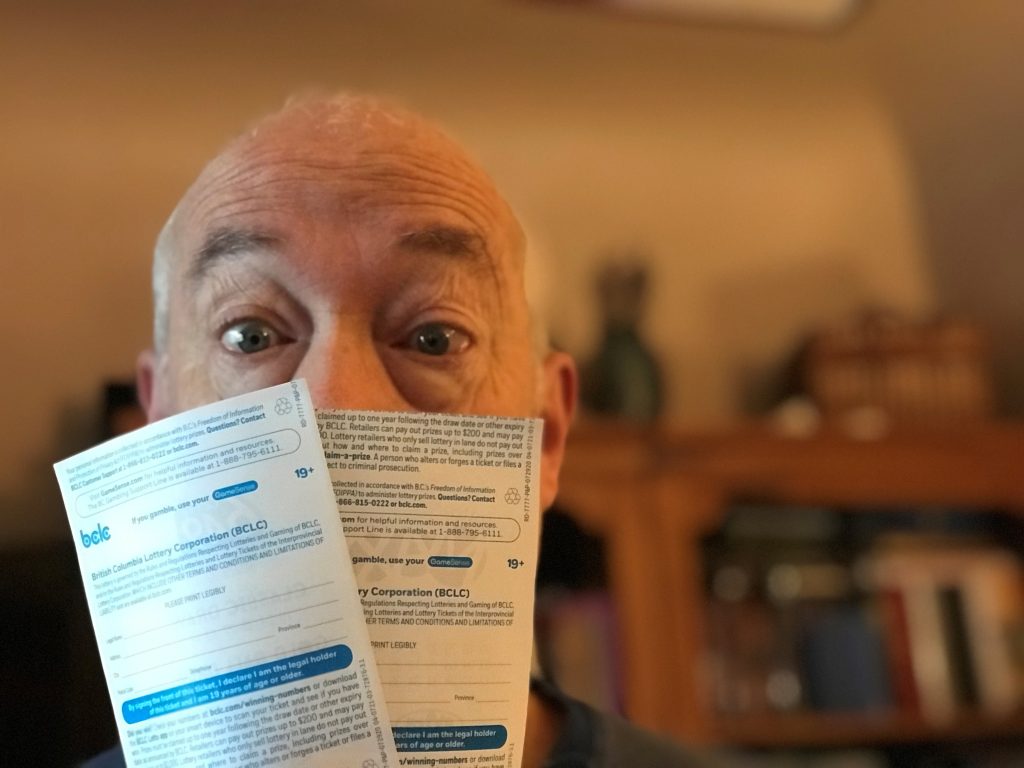

Did they sign their tickets? You would be surprised how often this simple step gets omitted. Joe Blow buys a lottery ticket, and he stuffs it in his wallet, or coat pocket, or the glove compartment (Really?! It’s essentially a form of bearer bond!) If someone else gets their hands on that ticket, Joe is going to be in for a long and protracted legal battle to get that ticket back. With no guarantee that he will. So sign the damn ticket at the lottery counter! In fact, take it a step further and take a selfie with the ticket. Smile!

2. Tell Everyone. Right Away.

You’re sitting enjoying a morning coffee before heading off to work. It’s lottery day, so you go online and check the winning numbers. “If only I had a million dollars”, you think to yourself. You’re heart leaps into your throat as you scan the numbers. They look like your numbers! You swallow the large lump in your throat and go over the numbers again, one by one, holding the ticket up to the computer screen. A small whimper escapes your lips. They are your numbers! Take a breath and check ’em again. Yup! You are about to be a gazillionaire!

Your first instinct might be to grab your phone and call your best friend, or your boyfriend, or throw open the kitchen window and shout “I’m filthy rich!” to the world outside. Better yet, post it on Facebook. What a great idea. Make it one of those “Life Events”. Maybe not. Attracting as much attention to yourself before you’ve even claimed the prize is guaranteed to make your life a living hell. Just. Don’t.

Instead, take another sip of that fine, dark roast, and breathe. Continuously. If your wife, husband, or significant other is nearby, calmly inform them that you believe you may just have won some money on the lottery. Don’t jump up and down. Don’t become hysterical. This is about the worst possible time to have a jammer. Especially if you haven’t signed the damn ticket yet!

At this point I’d like to make clear that I am unlikely to follow my own advice…Good thing I’m going for a stress test today.

3. Don’t Hire A Financial Adviser

I mean, who does this!? Such a waste of money! And after all, they’re just going to give you a bunch of financial advice that you probably already know. Like “Don’t spend it all in one place,” or “Remember to save for a rainy day.” Do you really want to spend your hard-earned (pure luck) lottery winnings on some expensive hack, when you know your neighbour Stan has never steered you wrong with his sage financial advice?

Unless of course the person you hire is a Fiduciary Financial Advisor. A what? Put simply, this person acts 100% on your behalf, putting your interests first. They steer clear of conflicts of interest, mainly by not steering you towards products or services or advice that benefits them. Here’s a quote from Wealthsimple:

“A fiduciary financial advisor is a financial advisor that has a fiduciary duty toward their client. A fiduciary duty means that they have an ethical and legal obligation to place your financial interests above all else and also cannot make commissions from managing your assets.”

Wealthsimple.com

Sounds like one of these might be a better choice than your neighbour Stan. So I guess number 3 should read, Don’t hire a regular, run-of-the-mill financial advisor.

4. Get Down To Lottery HQ Now

What are you doing still sitting at your kitchen table? The longer you wait, the more interest you’re losing! Go get that cheque right away! Call the limousine company and get the biggest stretch limo you can on short notice!

I mean, after all, that big lottery win is going to earn you so much interest, so shouldn’t it be in your bank account now? If I won a million dollars or more in a lottery, isn’t that the right thing to do? Not really. There’s a reason why lottery corporations provide up to a year to claim winnings. Grab the money too soon and the temptation is to start spending it. And before you know it, Poof! All gone.

So take a pause, maybe go on a little vacation to get away from your life, and think about it. This is going to be life-changing. Lots of big decisions to be made. If I had a million dollars, or a gazillion dollars, I’d want to make some important choices first. Short term, medium and long term, what do I want to achieve? I think that’s a lot easier to do before the cheque is deposited.

5. Don’t Set A Budget

Aren’t budgets for poor people? Well guess what? You’re not poor! You’ve just won the lottery, and you’re set for life! You don’t need no stinkin’ budget!

Okay, fine! I have had this discussion with my kids. So many people have this notion that a budget is too hard to stick to, so why bother? Or that it serves no purpose. I know I’ve struggled with maintaining a budget, but if I had a million dollars, I think I’d be crazy not to have one. Here’s an example of what having a budget after a lottery win can do.

A 23 year old man won $111 million in a Powerball lottery, and waited 4 months before claiming his prize. During that time, he worked with a lawyer and a financial planner to set up a corporation that purchased a ranch adjacent to the ranch he worked on. Once he claimed the winnings, he paid himself an annuity and kept the bulk of the remaining principal in low yield investments. He eventually sold the ranch for $40 million, and has not touched the principal of the original lottery prize.

If most of that was gobbledy-gook to some, it means he was smart and created a budget. And what’s the best thing about creating a budget? It helps you keep track of your money, even if (or especially if!) you’re only making 15 bucks an hour.

If I Had A Million Dollars, My Kids Would Suffer

Winning a big lottery when you have children is probably the worst thing you could do for them. The first thing it teaches them is that, in order to get ahead in life, give yourself over to blind luck. Do as I do, and make sure your retirement planning revolves around buying lottery tickets! Winning a lottery and retiring from your job, buying a fancy house and jetting around the world sets them up for impossible expectations. Maybe they decide not to work because they think Mom and Dad are going to provide for them forever. And maybe they will? After all, if you win a big payoff, wouldn’t you want to share it with your younglings?

See? This is why you need to plan before you pick up that big chunk of money. If I were to win the big payoff, I wouldn’t tell my kids, at least until I had things set up for them. I still want them to be responsible for their own lives when they become adults. They need to learn to be self-sufficient. Learn how to manage their finances, pay bills and create a budget!

Are you paying attention, certain children that may or may not be related to me?

I thought not.

Do you remember the good ole days when proceeds from provincial lotteries went to amateur sport associations? That didn’t last long. Now it goes to general revenues.

Indeed it has become an indispensable form of tax revenue. So next time you have the urge to put down $5 on a Lottomax ticket with odds of winning at 1 in 33,294,800 just imagine that that person taking your fiver is there to collect taxes for the Canada Revenue Agency.

Yup. Amateur sports and charities. That’s why it’s better to just hand your fiver to a homeless person.

I’ve only been a subscriber for a couple of weeks but I gotta say that I am enjoying your topics and your writing style. Always a good read that adds light and levity to my day. Looking forward to next week’s edition!

Thanks for your kind words, John! I guess I better get cracking for my next post. (Whatever shall it be?)

After the Scotsman had won big time on the lottery his wife asked ” but Jock, what about the begging letters ?”to which he replied ” keep sending them lassie ” !

Ha! What do you suppose the letters would say after winning the lottery? “We’re having a tough go of it scraping by on a few million pounds! Could you see yer way to sendin’ us yer extra dosh?”